LEARNING OBJECTIVES

Upon completion of this module, the student will be able to:

1. Identify the three areas the IRS recognizes as issues for construction businesses when calculating tax liabilities

2. Understand the cash method of accounting including its limitations

3. Describe how to choose an accrual method of accounting based from business practices and business size

4. Understand the accrual methods of accounting including EPCM, PCM, & CCM

5. Understand the advantages and disadvantages of using the different accrual methods of accounting

6. Discuss why capitalization of indirect costs is an important issue and methods to mitigate this issue

7. Identify the three factors used to determine if a worker is an employee or independent contractor including methodologies within each factor

Introduction

Whether you have an existing business or just starting one, a full understanding and compliance to the tax laws is essential to keep your business running effectively and to eliminate unwanted or surprising tax burdens or penalties.

The Internal Revenue Service has identified several issues that may cause problems for the owners of small construction businesses.

These issues include:

Accounting Methods

Capitalization of Indirect Costs to Long-Term Contracts

Independent Contractor or Employee Classification

By recognizing the significance of these issues, small construction business owners can properly file their tax returns and avoid costly problems.

ACCOUNTING METHODS

There are special tax rules that control the accounting method you must use for your construction business. Generally, you choose your tax accounting method when you file your first tax return for the business.

Your choice of accounting method depends on:

The type of contracts you have,

Your contracts’ completion status at the end of your tax year, and

Your average annual gross receipts.

Most construction businesses use two different tax accounting methods; one for their long-term contracts (more than 1 year in length) and one overall method for everything else.

| Note: Majority of construction businesses use the Accrual Method for their overall method of accounting. |

CASH METHOD

A contractor using the cash method of accounting reports cash receipts as income when received and deducts expenses when paid. If you pay an expense that benefits you for more than one tax year, you must spread the cost over the period you receive the benefit.

| Example: You pay $1,000 in Year 1 for a business insurance policy that is effective for one year, beginning July 1st. You can deduct $500 in Year 1 and $500 in Year 2. |

In the cash method, income may be actually or constructively received. If you received a check from a customer in Year 1 but did not deposit or cash it until Year 2, it is still included in income in Year 1 because that’s the year you actually received it.

Constructive receipt

Constructive receipt occurs when you have unrestricted access to income you have earned.

| Example: If a customer called you in December and told you that a payment for a job was ready, but you didn’t pick it up until January, you would have constructive receipt of the income in December. |

If someone else receives the money for you, you have constructively received the money.

The key to constructive receipt is

IF you could have received the money in one year but chose not to receive it until a later year, it must be included in your income in the first year as if it had been actually received in that year. You cannot postpone including it in your income until the next year.

Limitations

There are two situations in which your use of the cash method of accounting can be limited:

• First, you are not allowed to use the cash method if your business is a corporation or a partnership with a C corporation as a partner, whose average annual gross receipts exceed $5 million. There is no exception to this limitation.

• Second, depending on what type of business you have, you may not be allowed to use the cash method if your total purchases of “merchandise” for the year are “substantial” compared to your gross income for the year.

ACCRUAL METHODS

If you can’t use the cash method, you must choose an accrual method of accounting. In the construction industry, there are several specialized accrual methods available, each of which has its own set of rules and limitations. In general, all accrual methods attempt to match the expenses that relate to a specific contract to the income from that contract.

| Note: The following use calendar tax year, from the 1st of January to the 31st of December. |

Choosing an Accrual Method

Choosing a permissible method of accounting for tax purposes involves the three steps discussed below. As your business grows and changes, you might have to use a different method of accounting. You should review the following three steps every year to ensure that you are using a permissible method of accounting for your construction contracts.

1) Classify all Construction Contracts as either Short-Term or Long-Term.

A long-term contract is any contract that spans a year-end. If you have a contract that you start on December 26th but do not complete until January 23rd, you have a long-term contract. Therefore, a short-term contract is any contract you start and finish within one taxable year.

Use your overall method (i.e. accrual or cash, if allowed) for your short-term contracts. You must then choose an accounting method for all your long-term contracts. The rest of these steps will lead you through the process of choosing your long-term contract accounting method.

2) Classify all Long-Term Contracts as either Home Construction or General Construction Contracts.

Home Construction Contracts are contracts for work on buildings that have four or fewer dwelling units. Eighty percent or more of the estimated total contract costs must be for the construction, improvement, or rehabilitation of these units. If a contract is not a home construction contract, it is a general construction contract.

| Example: Contracts to build single-family homes, duplexes, triplexes, or quadplexes would be home construction contracts. Contracts to build apartment buildings would not be home construction contracts. |

3) Classify Yourself as Either a Small or Large Contractor

This is a two-part step. The first part is to measure your average annual gross receipts for the last three tax years of your construction business.

If the amount is $10 million or less, you are a small contractor.

If it is more than $10 million, you are a large contractor and do not have to consider the second part of this step.

Large Contractors

Large contractors are required to account for long-term contracts using the percentage-of-completion method (PCM) for their general construction contracts. Under PCM, contract income is reported annually according to the percentage of the contract completed in that year. For example, if a contract is 50% complete at the end of the taxable year, 50% of the contract income would be included in taxable income.

Small Contractors

If you are a small contractor, the second part of this step requires that you separate your long-term general construction contracts into two categories. The first category is those contracts that are reasonably likely to be completed within two years from the date work begins.

The second category is long-term general construction contracts that you estimate will take two years or more to complete. For these longer-duration contracts, you must use a large contractor method, even though you are a small contractor.

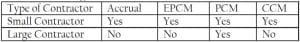

• As a Small Contractor, you should use either: Accrual, Exempt Percentage of Completion Method (EPCM), Completed Contract Method (CCM), or Percentage of Completion Method (PCM) for all your general construction contracts.

This table shows the methods that are available to use on your general construction contracts. Most contractors will use the Accrual Method for their overall method of accounting.

Types of Costs

Before you can understand how the different accrual methods work, it’s important to know about the different types of costs your construction business will have.

The two basic categories of costs your construction business will have are job costs and general and administrative (or G&A) costs.

• Job Costs are the expenses related, either directly or indirectly, to the construction job, like construction wages, materials, and allocated indirect costs.

• G&A Expenses are the day-to-day expenses of running the business, like office expenses and utilities. However, certain administrative costs are sometimes treated like indirect job costs to figure the income earned on a contract.

Job Costs

Job costs are divided into two groups. Direct job costs such as labor, materials, and subcontractor expenses can be traced directly to the construction project. The wage paid to a site manager is an example of a direct labor cost. Similarly, direct materials would include lumber for framing a house or concrete for the foundation of a shopping center.

Direct costs also include amounts paid to subcontractors. Subcontractors work for and are paid by the general contractor on a project. Subcontractors may also provide the raw materials for the job. Labor and materials provided by a subcontractor are generally treated as direct costs.

Indirect job costs are all the costs necessary for the performance of the contract other than direct materials, direct labor, and subcontractors. The expenses included in indirect job costs differ depending on whether you are a small or large contractor.

General and Administrative Expenses

General and administrative (G&A) expenses are indirect costs of operating a construction business that cannot be traced to specific jobs. However, certain administrative costs may be treated like indirect job costs. The following lists G&A expenses for contractors:

- Repair & maintenance expenses for equipment & facilities

- Utilities

- Rent of equipment & facilities

- Quality control

- Taxes relating to labor, materials, supplies, equipment or facilities

- Administrative costs

- Indirect materials and supplies

- Tools & Equipment

- Depreciation

- Insurance on equipment & machinery

- Indirect labor and contract supervisory wages

- Production period interest expense

Allocating Indirect Costs

Indirect job costs benefit the project but are not tied as clearly to it as direct costs are. Indirect job costs often involve expenses that benefit more than one job and must be allocated among all the jobs that received benefit.

ACCRUAL METHOD OF ACCOUNTING

Income: You include an item in income in the tax year when all events have occurred that fix your right to receive the income and you can determine the amount with reasonable accuracy. Generally, Report income:

When it’s earned, or

When it’s due from the customer, or

When it’s received from the customer,

Whichever is earlier.

• Income is generally earned when you have finished the work to your customer’s satisfaction and due when you bill your customer. This means that sometimes you will include an item in income before you have actually received payment.

| Note: You may use this method for your long-term contracts only if your annual gross receipts do not exceed $10 million AND the estimated completion time does not exceed 2 years. |

Advance Payments

• Generally, advance payments for services are included in income when you receive the payment. You may delay including an advance payment in income until the next tax year for services you will perform in a subsequent year per the provisions of IRS Procedure 2004-34.

Expenses: G&A expenses and job costs are deducted in the tax year you incur them. An expense is incurred:

The later of:

When the merchandise or services are received, or

When the amount of the expense can be accurately determined

• This means that sometimes you will deduct expenses before you actually pay them. However, if you pay an expense that benefits you for more than one tax year, you must spread the cost over the period you receive the benefit.

• You also cannot take an immediate deduction for any capital expenditures. Examples of capital expenditures are buildings, machinery, equipment, furniture and fixtures, and similar property having a useful life substantially beyond the taxable year. Generally, capital expenditures must be deducted by means of depreciation or amortization.

• The one variation on the accrual method is an election to exclude retainages from income until you have an unconditional right to receive them. If you make this election, you also have to wait to deduct retainages payable until they are paid.

• You cannot elect to exclude retainages if you use the PCM or CCM methods.

For the cash or accrual method of accounting, it isn’t necessary to trace job costs to a particular job. However, many businesses keep track of which costs relate to which job to have more accurate data on the profitability of their jobs and to improve their bidding process. If you use the Percentage of Completion or Completed Contract Method, it is very important to keep each job’s costs separate.

Advantages of Accrual Method

It provides better matching of income and expenses

It gives a more accurate picture of your financial position than the cash method

| Note: If you have jobs that extend over the year-end, you may want to choose the Percentage of Completion or Completed Contract Method. They may be more advantageous to you than the accrual method. |

EXEMPT PERCENTAGE OF COMPLETION METHOD (EPCM)

The Exempt Percentage of Completion Method (EPCM) is a method that only affects how your income is computed and reported on your tax return. When you use this method, all G&A and job costs are deducted using the accrual method.

With this method, you report income from long-term contracts as work progresses. A long-term contract is any contract that spans a year-end. If you have a contract that you start on December 26th but do not complete until January 23rd, you have a long-term contract. You will report some income in each year of a long-term contract.

Advantages of EPCM:

It is the most accurate way to measure income

It evens out the reporting of income over the life of the contract

Losses may be recognized based on the percentage of the contract completed

It is the method preferred by most banks and bonding companies

Disadvantages of EPCM:

Its complexity

It accelerates income compared to other methods.

To determine your current year’s gross receipts from a long-term contract, you multiply its “completion factor” (i.e., percentage of completion) by its “total contract price” and then subtract the amount of gross receipts you previously reported for this contract. You compute your gross receipts in this way even if you bill the customer for a different amount.

Compute your Income

There are two ways to compute your income under EPCM, either the cost comparison method or the work comparison method. Both of these methods are explained in detail below.

EPCM Cost Comparison Method

You compute your income under this method by dividing the deductible job costs for the year by the estimated total job costs. This percentage is multiplied by the contract price to figure out how much income to report in each year. The contract price has to include all retainages receivable, any change orders agreed upon at the time of the computation, and any reimbursements for costs incurred by the contractor.

• The income to be reported on the tax return is computed this way even if the customer is billed a different amount.

• Notice that even though G&A and Job Costs are deducted under the accrual method, Job Costs are used in the computation of income under the EPCM Cost Comparison Method.

EPCM Work Comparison Method

You compute a contract’s completion factor by comparing the work performed to date to estimated work to be performed. For each year of the contract, the completion factor must be certified by an architect or engineer or otherwise supported by appropriate documentation.

COMPLETED CONTRACT METHOD

With this method, you report all the income from the contract and deduct all the related job costs in the year the project is considered complete.

• The number of indirect costs that you must characterize as job costs will vary depending on your size. In general, a large homebuilder has to capitalize a greater number of indirect costs than a small homebuilder or small general contractor. You should consult your tax advisor regarding types of indirect costs that you must capitalize.

• G&A expenses, net of any amounts included in job costs, should be deducted as explained in the Accrual Method.

Advantages of CCM:

It normally achieves the maximum deferral of taxes.

Disadvantages of CCM:

The books and records do not show clear information on operations

Income can be bunched into a year when a lot of jobs are completed, and

Losses on contracts are not deductible until the contracts are completed

May only be used by small contractors and any home construction contracts.

| Note: Many taxpayers will choose to use PCM as their long-term contract method for their books (so they can give their banks and bonding companies the type of financial statements they prefer) and CCM for their tax returns (so they can have the maximum deferral of taxes). |

CAPITALIZATION OF INDIRECT COSTS TO LONG-TERM CONTRACTS

Contractors are required to allocate indirect job costs to their long-term contracts annually unless the Code or regulations provide otherwise.

Whether contractors are required to capitalize these allocable job costs, or are permitted to deduct these allocable job costs, depends on the contractor’s method of accounting for long-term contracts.

Allocable job costs include costs that are incurred because of the contractor’s construction projects, such as repairs, equipment maintenance and rentals, utilities at the job site, depreciation on construction equipment, officer’s compensation, and workers’ compensation insurance.

Non-allocable job costs included expenses for unsuccessful bids and proposals and for marketing, selling, and advertising expenses. These costs are exempted from the cost allocation requirement.

In general, contractors using the percentage of completion method are required to allocate indirect job costs to their long-term contracts. Contractors using the completed contract method of accounting are required to capitalize indirect job costs allocated to long-term contracts until the contract is completed.

Why is the Capitalization of Indirect Costs an Important Issue?

Many contractors utilizing the completed contract method of accounting overstate their deductions because they are not properly allocating costs to long-term contracts. Under the completed contract method, income or loss is reported in the year in which the contract is completed. In addition to direct materials and labor costs, all indirect costs incurred for reason of a long-term contract or that directly benefit the long-term contract, must be allocated, or capitalized to that contract. As long as that contract has not been completed and accepted, these costs must not be deducted as current period costs.

Some indirect costs may benefit both the long-term contract and other business activities. These costs will require a reasonable allocation between the other business activities and the long-term contract. Suggested methods are specific identification method or the use of ratios based on direct costs, hours, or other units of measure.

INDEPENDENT CONTRACTOR OR EMPLOYEE CLASSIFICATION

Before you can know how to treat payments you make for services, you must first know the business relationship that exists between you and the person performing the services. The person performing the services may be an employee or an independent contractor. The three factors to consider when making this determination are:

Behavioral Control

Financial Control

Relationship of the Parties

BEHAVIORAL CONTROL

Behavioral control refers to facts that show whether there is a right to direct or control how the worker does the work. A worker is an employee when the business has the right to direct and control the worker. The business does not have to actually direct or control the way the work is done – as long as the employer has the right to direct and control the work.

- The behavioral control factors fall into the categories of:

- Type of instructions given

- Degree of instruction

- Evaluation systems

- Training

Types of Instructions Given

An employee is generally subject to the business’s instructions about when, where, and how to work. All of the following are examples of types of instructions about how to do work.

• When and where to do the work.

• What tools or equipment to use.

• What workers to hire or to assist with the work.

• Where to purchase supplies and services.

• What work must be performed by a specified individual.

• What order or sequence to follow when performing the work.

Degree of Instruction

Degree of Instruction means that the more detailed the instructions, the more control the business exercises over the worker. More detailed instructions indicate that the worker is an employee. Less detailed instructions reflects less control, indicating that the worker is more likely an independent contractor.

| Note: The amount of instruction needed varies among different jobs. Even if no instructions are given, sufficient behavioral control may exist if the employer has the right to control how the work results are achieved. A business may lack the knowledge to instruct some highly specialized professionals; in other cases, the task may require little or no instruction. The key consideration is whether the business has retained the right to control the details of a worker’s performance or instead has given up that right. |

Evaluation System

• If an evaluation system measures the details of how the work is performed, then these factors would point to an employee.

• If the evaluation system measures just the end result, then this can point to either an independent contractor or an employee.

Training

If the business provides the worker with training on how to do the job, this indicates that the business wants the job done in a particular way.

This is strong evidence that the worker is an employee. Periodic or on-going training about procedures and methods is even stronger evidence of an employer-employee relationship. However, independent contractors ordinarily use their own methods

FINANCIAL CONTROL

Financial control refers to facts that show whether or not the business has the right to control the economic aspects of the worker’s job.

The financial control factors fall into the categories of:

• Significant investment

• Unreimbursed expenses

• Opportunity for profit or loss

• Services available to the market

• Method of payment

Significant investment

An independent contractor often has a significant investment in the equipment he or she uses in working for someone else. However, in many occupations, such as construction, workers spend thousands of dollars on the tools and equipment they use and are still considered to be employees. There are no precise dollar limits that must be met in order to have a significant investment. Furthermore, a significant investment is not necessary for independent contractor status as some types of work simply do not require large expenditures.

Unreimbursed expenses

Independent contractors are more likely to have unreimbursed expenses than are employees. Fixed ongoing costs that are incurred regardless of whether work is currently being performed are especially important. However, employees may also incur unreimbursed expenses in connection with the services that they perform for their business.

Opportunity for profit or loss

The opportunity to make a profit or loss is another important factor. If a worker has a significant investment in the tools and equipment used and if the worker has unreimbursed expenses, the worker has a greater opportunity to lose money (i.e., their expenses will exceed their income from the work). Having the possibility of incurring a loss indicates that the worker is an independent contractor.

Services available to the market

An independent contractor is generally free to seek out business opportunities. Independent contractors often advertise, maintain a visible business location, and are available to work in the relevant market.

Method of payment

An employee is generally guaranteed a regular wage amount for an hourly, weekly, or other period of time. This usually indicates that a worker is an employee, even when the wage or salary is supplemented by a commission. An independent contractor is usually paid by a flat fee for the job. However, it is common in some professions, such as law, to pay independent contractors hourly.

RELATIONSHIP OF THE PARTIES

Type of relationship refers to facts that show how the worker and business perceive their relationship to each other.

The factors, for the type of relationship between two parties, generally fall into the categories of:

• Written contracts

• Employee benefits

• Permanency of the relationship

• Services provided as key activity of the business

Written Contracts

Although a contract may state that the worker is an employee or an independent contractor, this is not sufficient to determine the worker’s status. The IRS is not required to follow a contract stating that the worker is an independent contractor, responsible for paying his or her own self-employment tax. How the parties work together determines whether the worker is an employee or an independent contractor.

Employee Benefits

Employee benefits include things like insurance, pension plans, paid vacation, sick days, and disability insurance. Businesses generally do not grant these benefits to independent contractors. However, the lack of these types of benefits does not necessarily mean the worker is an independent contractor.

Permanency of the Relationship

If you hire a worker with the expectation that the relationship will continue indefinitely, rather than for a specific project or period, this is generally considered evidence that the intent was to create an employer-employee relationship.

Services Provided as Key Activity of the Business

If a worker provides services that are a key aspect of the business, it is more likely that the business will have the right to direct and control his or her activities. For example, if a law firm hires an attorney, it is likely that it will present the attorney’s work as its own and would have the right to control or direct that work. This would indicate an employer-employee relationship.

REFERENCES

IRS.gov: Independent Contractor (Self-Employed) or Employee?

IRS.gov: Tax Tips – Construction